Objectives of the service

This project addresses the non-functioning market for capital allocation to smallholders. We see a clear market opportunity to provide information about where capital can be directed with the highest expected value creation.

The service embodies a necessary link between capital and technology providers. We apply our simulations to provide insight into how capital investments affect individuals, organisations, and communities, and in doing so, close the information gap.

Key clients are informed agricultural buyers/producers with a vested interest in smallholders. These large, often multinational, companies are reliant on smallholders to source a proportion of their produce - be it coffee, cocoa, palm oil, or any number of similar goods. Therefore, any yield increases that the smallholders can gain - through better seed, pesticide, or fertiliser - will ultimately also benefit the buyer who they trade with. Examples of companies in this sector include Cargill, Bunge, Sime Darby and Unilever.

Users and their needs

Our focus clients/users can be split into three groups.

Credit providers include financial institutions which provide credit either directly to smallholders, or via an intermediary. They require:

- A consistent, valid and reliable methodology for identifying credit risks, allowing them to consider smallholders as clients

- Presentation of data in a mix of dashboards, spreadsheets and financial analytics graphics

- Push warnings for credit default risk increase

Many large agribusinesses have lending schemes for their smallholder growers, allowing them to purchase the inputs, tools and seed, and then pay back the cost out of the resulting yield increase.

For this customer group, our service requires:

- Information on actual productivity vs potential productivity

- Information on redundancy in the agricultural production system (storage, roads, etc.)

- Information on crop types, ownership, farm sizes

Our final customer group is ‘technology providers’, including equipment and fertiliser, seed, pesticide and herbicide. Technology providers look to provide credit to potential customers in order to facilitate increased sales and uptake. This group requires:

- Information on irrigation practices, soil types, crop types, roads and distribution systems

- Information on production potential gaps

- Information on co-ops, buyers, markets and human capital

The two latter will be our first target clients, as they are a necessary enabler for the former to provide capital.

Worldwide - the service can be adapted to be useful for both smallholders and medium to large plantations.

Service/ system concept

The service utilises predictive and prescriptive simulations to assess system effects of credit deployment. With its dynamic data consumption, and iterative and reactive simulations, the service can provide a continually updated prediction of how robust the credit providers portfolio is.

We go deep into the operations and economics of smallholder production systems and can thus provide much more granular data than any other competitor. Satellite data enables the digital environment in which we perform our simulations, and auxiliary data enables more informed models and eventually actionable simulation outputs.

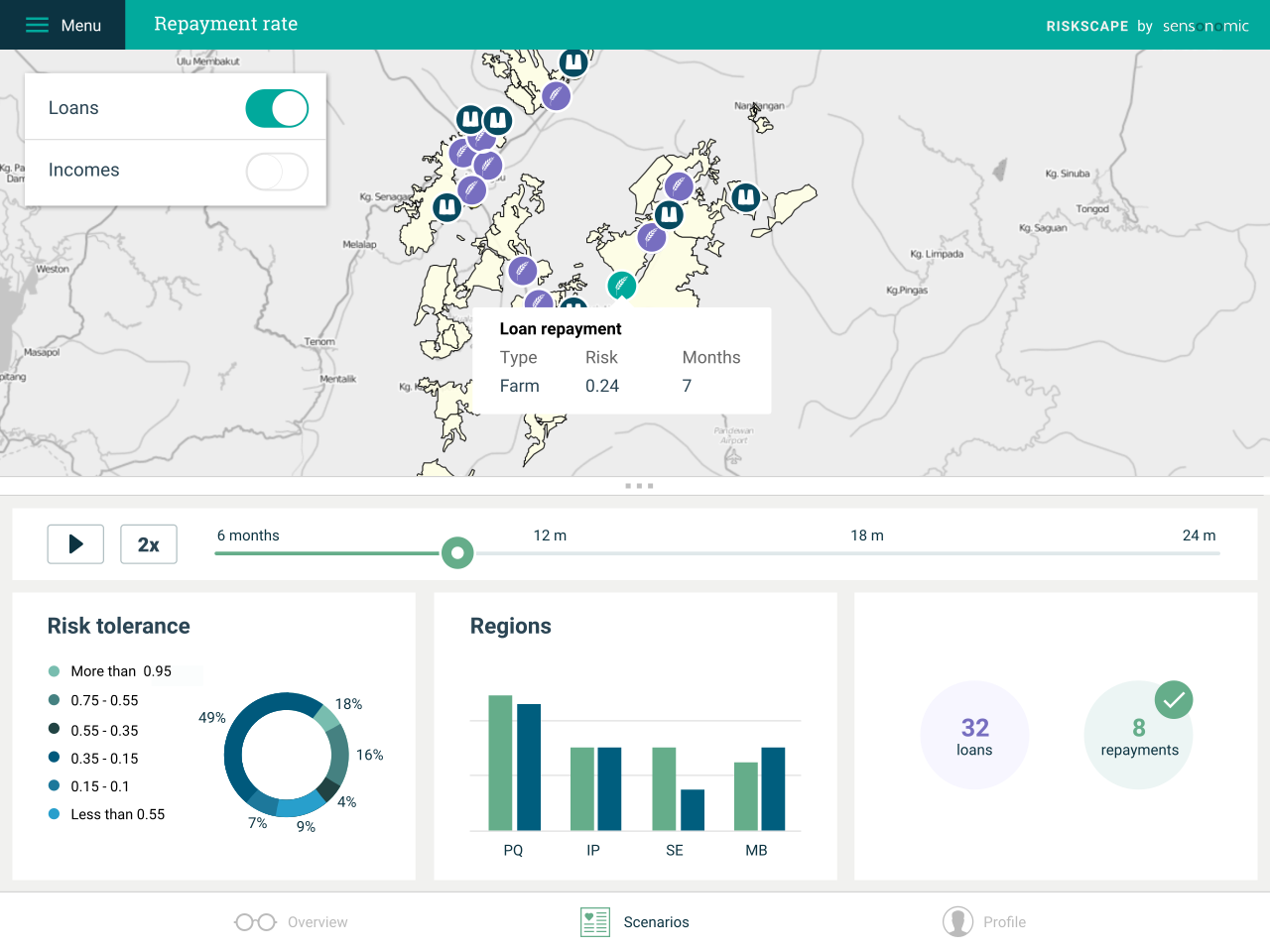

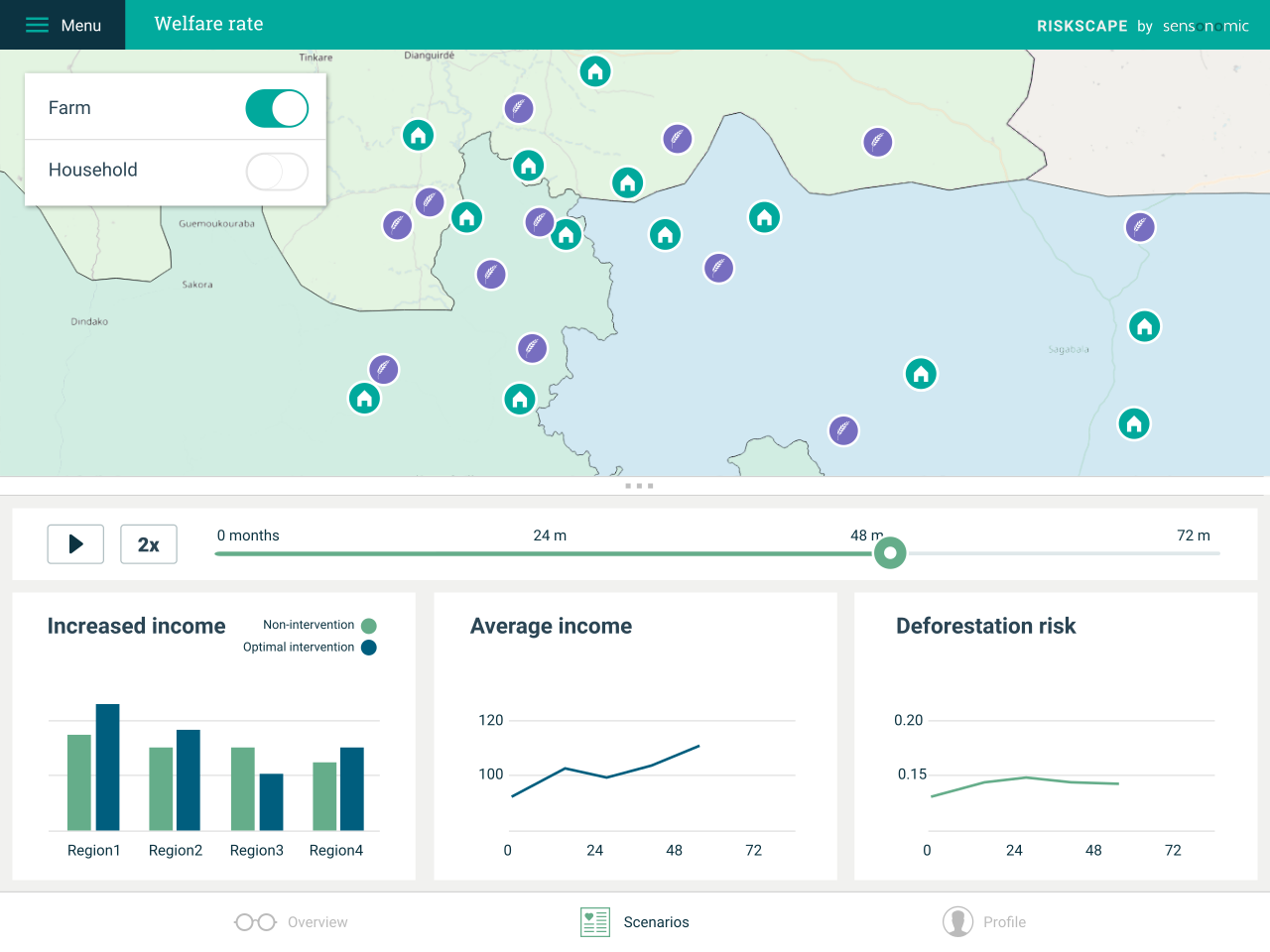

The system’s intuitive dashboard (see mock ups below) allows users to investigate the future impact of different lending scenarios. We considered two different modes of optimisation - optimisation purely for best repayments rate, and then optimisation where both repayment rate and socio-economic welfare of the smallholders were considered. The former is purely business focus, whereas the latter takes a more holistic view, and it likely to appeal to not only socially responsible credit providers and development banks, but also governments and NGOs.

Space Added Value

Our simulations allow value to be added to the Sentinel data they consume. In the simulations we can create autonomous and interacting individuals and organisations - allowing us to find unexpected answers to what drives profitability and risk exposure. In the case of smallholder credit, models consume Sentinel data, as well as other data streams on local financial status, and weather conditions. The model is then able extract insights into predicted yield and welfare impacts, given different scenarios of credit provision in a region. This adds value to satellite imagery and allows users to test policy effects in advance.

There are few other companies acting in the sector of smallholder credit risk assessment, although there are others using satellite data to provide insights for agriculture. We are confident, however, that our methods of simulation and dynamic data integration provide something unique to this sector. It should also be remembered that the agricultural and non-agricultural financing needs of the roughly 270 million smallholder farmers in Latin America, sub-Saharan Africa, and South and Southeast Asia are estimated to exceed USD 200 billion – therefore the market is far from being saturated.

Current Status

We have completed our concept delivery for a feasibility study. We focused on developing an interface and initial infrastructure to build trust with our target clients and will in the next phase use current development to spend time with the clients and learn more about their potential user scenarios.

The project involved significant user interaction, initially with financial service providers and subsequently with big agricultural companies. The latter will be the focus of continued service development.

The initial scenario was developed with input from a leading financial institution and agriculture finance provider, industry experts in smallholder agriculture and technology and fertiliser providers to global agriculture.

We have received positive feedback from three of our target clients, yet they require evidence of a more mature concept before being willing to commit to the project. We therefore continue to “productify” our mock-ups so to enable more informed discussions with our clients.